Key Principles to Help Improve Your Odds of Success

While many investors get caught up in trying to time the market or chase the latest hot investment, academic research has identified ten key principles that can significantly improve your odds of investment success. From embracing market pricing to managing your emotions during volatility, these strategies focus on what you can control rather than what you can’t predict.

Below, we’ll explore each principle and show you how the financial markets have consistently rewarded investors who stay disciplined and think long-term.

1. Embrace Market Pricing

Financial science has taught us that the market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices.

2. Don’t Try to Outguess the Market

The market’s pricing power works against stock pickers and market timers: Only 17% of US-domiciled funds beat their benchmarks over the past 20 years. In contrast, by using information in prices, 84% of Dimensional funds have beaten their benchmarks in that time.

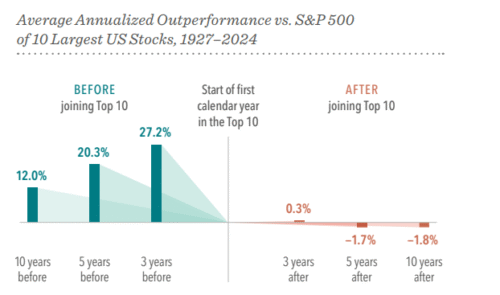

3. Resist Chasing Past Performance

Some investors make choices based on past returns. Yet past performance offers little insight into future returns. For example, stocks that have grown to be among the 10 biggest in the US have tended to lag the overall market after reaching that size, failing to maintain their strong performance.

Average Annualized Outperformance vs. S&P 500 of 10 Largest US Stocks, 1927–2024

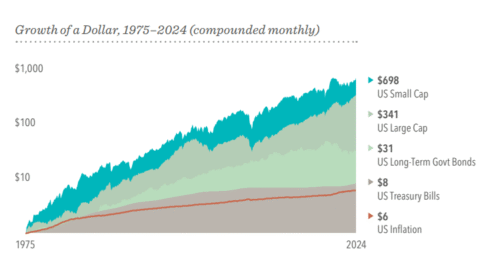

4. Let Markets Work for You

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and the stock and bond markets have provided growth of wealth that has more than offset inflation, as this chart of the past 50 years shows.

Growth of a Dollar, 1975–2024 (compounded monthly)

5. Target Higher Returns

Academic research into decades of stock and bond returns has identified long-term drivers of outperformance. By investing systematically in the areas with higher expected returns, you can aim to beat the market.

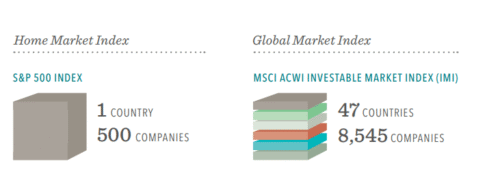

6. Diversify Internationally

Holding a globally diversified portfolio can broaden your opportunities beyond your home market—putting you in a better position to capture higher returns wherever they appear.

Home Market Index vs. Global Market Index

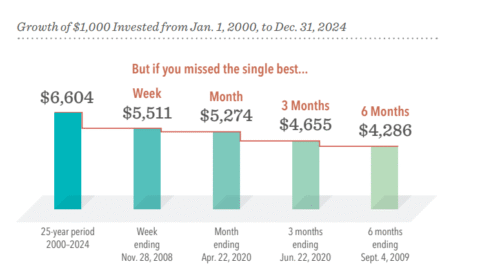

7. Avoid Market Timing

Research has shown there’s no reliable way to time the market—targeting the best days to be invested or moving to the sidelines to avoid the worst days. It has also shown the impact of being out of the market even for a short time. Staying invested helps ensure you’re in position to capture long-term gains.

Growth of $1,000 Invested from Jan. 1, 2000, to Dec. 31, 2024

8. Manage Your Emotions

When markets go up and down, many people struggle to separate their emotions from investing. Reacting to current market conditions may lead to making poor investment decisions.

9. Look Beyond the Headlines

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source—is it news or entertainment? Do yourself a favor and tune out the noise.

10. Control What You Can Control

Work with your financial advisor to stay focused on actions that add value. While you can’t control which way the market will turn, following time-tested principles can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance

- Structure a portfolio along the dimensions of expected returns

- Diversify globally

- Manage expenses, turnover, and taxes

- Stay disciplined through the market’s highs and lows

How Prosperity Capital Advisors Helps You Implement These Principles

These ten principles form the foundation of our investment philosophy at Prosperity Capital Advisors and guides how we help clients build wealth over time. Rather than chasing market trends or trying to time the perfect entry and exit points, we focus on disciplined, long-term investing using The Bucket Plan® methodology.

By organizing your assets into buckets based on when you’ll need them, we help you stay disciplined during market volatility while positioning your portfolio to capture the long-term growth potential that markets have historically provided. This evidence-based approach, combined with our holistic planning process, helps ensure you’re building a complete financial strategy designed for your unique goals and timeline.

Ready to put these time-tested investment principles to work in your financial plan? Connect with a Prosperity advisor today to discover how evidence-based investing can help you pursue a better investment experience.

Past performance is no guarantee of future results.

Disclosure: Prosperity Capital Advisors prioritizes client interests with a planning-first approach, offering tailored strategies that account for market unpredictability and varying return patterns. Our dedicated team helps clients avoid common pitfalls such as expecting “average” returns and short-term market timing, ensuring strategies are built around individual goals and long-term investment horizons rather than annual return predictions. Find your local Prosperity advisor today today to learn how we can help you optimize your tax strategies while building long-term wealth.

This blog was created based on content from Dimensional Fund Advisors. The original article “Pursuing a Better Investment Experience” appeared in Dimensional’s client communications. Learn more about Dimensional Fund Advisors here. The original post was published on June 06, 2025 and can be found here.

Important Disclosures

Data sources include Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, S&P Dow Jones Indices LLC, Center for Research in Security Prices (University of Chicago), Ibbotson Associates, and US Department of Labor Bureau of Labor Statistics. Indices are not available for direct investment and their performance does not reflect expenses associated with management of an actual portfolio.

Diversification neither assures a profit nor guarantees against a loss in a declining market. There is no guarantee investment strategies will be successful. International investing involves special risks, such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy, or an offer of any services or products for sale. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.