In the first half of 2025, developed markets outside the US returned 19.0%, outperforming the US and emerging markets.1 But that outcome masks the wide range of returns across individual countries, from Spain’s 43.0% to Denmark at −5.5%. This kind of dispersion isn’t unusual—it’s a defining characteristic of global investing.

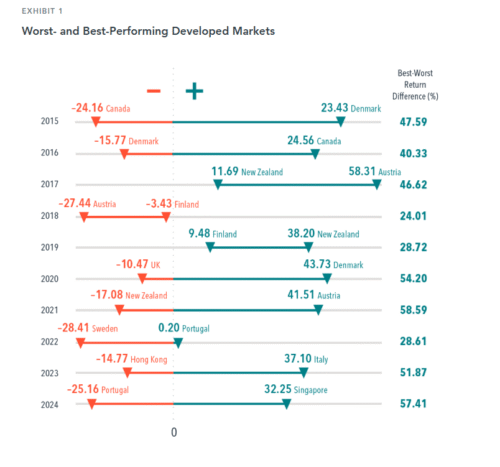

On average, the difference in return between the best- and worst-performing country exceeded 43% over the past 10 calendar years. It’s no wonder investors may be tempted to chase recent winners or try to avoid losers. However, there’s little evidence that timing strategies consistently pay off. Country returns can turn quickly. For example, Canada posted the worst returns in 2015, down over 24%, but was the top performer in 2016, up over 24%. An investor who lost patience at the end of 2015 potentially missed out on the subsequent market recovery.

Country volatility is a normal part of global investing. Fortunately, as 2025 illustrates, investors in a globally diversified portfolio can benefit from international diversification without risking getting on the wrong side of country swings.

How Prosperity Capital Advisors Helps You Implement These Principles

Spain gained 43% while Denmark lost 5.5% in the first half of 2025—a massive 48.5% difference that shows why trying to pick winning countries doesn’t work. At Prosperity Capital Advisors, we’ve seen too many investors chase last year’s top-performing market only to miss the next opportunity.

This type of market volatility is exactly why we take a comprehensive approach to your financial plan using The Bucket Plan®. By organizing your assets into buckets based on when you’ll need them, we help you stay disciplined during market volatility while positioning your portfolio to capture returns wherever they occur.

This evidence-based methodology, combined with our holistic planning process, helps ensure you’re building a complete financial strategy designed for your unique goals and timeline.

Tired of missing out on market opportunities? Connect with a Prosperity advisor today

Past performance is not a guarantee of future results.

Disclosure: Prosperity Capital Advisors prioritizes client interests with a planning-first approach, offering tailored strategies that account for market unpredictability and varying return patterns across global markets. Our dedicated team helps clients avoid common pitfalls such as chasing past performance in individual countries and attempting to time international markets, ensuring strategies are built around individual goals and long-term investment horizons rather than geographic predictions. Find your local Prosperity advisor today to learn how we can help you capture global opportunities through disciplined diversification.

This blog was created based on content from Dimensional Fund Advisors. The original article “Mind the Gap—Diversifying Across Countries” appeared in Above the Fray, a weekly newsletter for Dimensional clients. Learn more about Dimensional Fund Advisors here. The original post was published on July 17, 2025 and can be found here.

Footnotes

- Measured by the MSCI World ex USA Index (net dividends), MSCI USA Index (net dividends), and MSCI Emerging Markets Index (net dividends).